Navigating The Uncharted Waters: Forecasting Real Estate Price Trends In 2025

Navigating the Uncharted Waters: Forecasting Real Estate Price Trends in 2025

Navigating the Uncharted Waters: Forecasting Real Estate Price Trends in 2025

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Uncharted Waters: Forecasting Real Estate Price Trends in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Uncharted Waters: Forecasting Real Estate Price Trends in 2025

The real estate market is a dynamic entity, constantly fluctuating under the influence of a myriad of factors. Predicting future price trends is an intricate exercise, requiring a deep understanding of these forces and their potential impact. While pinpointing exact figures is impossible, a comprehensive analysis of current market conditions, economic indicators, and emerging trends can shed light on potential price trends real estate 2025.

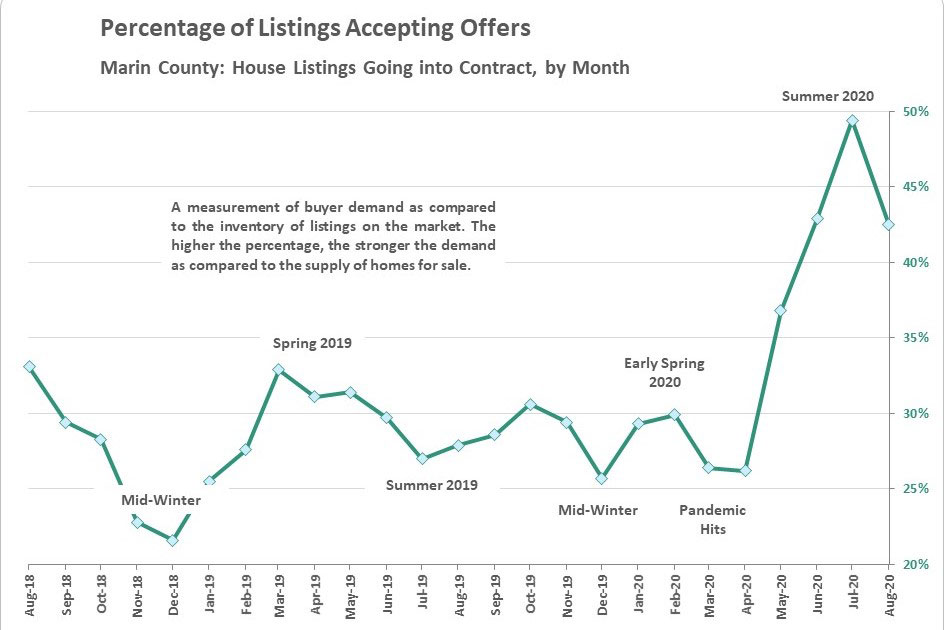

Understanding the Current Landscape

Before delving into projections, it’s crucial to understand the current state of the real estate market. The recent years have witnessed a surge in home prices, driven by factors such as low interest rates, pent-up demand, and limited inventory. However, this upward trajectory has started to show signs of slowing down. Rising inflation, increasing mortgage rates, and economic uncertainties have dampened buyer enthusiasm.

Key Factors Shaping the Future

Several key factors will significantly influence price trends real estate 2025:

- Interest Rates: The Federal Reserve’s monetary policy plays a pivotal role in shaping mortgage rates. Higher interest rates make borrowing more expensive, potentially cooling demand and impacting affordability.

- Economic Growth: A robust economy typically translates to increased job creation and higher wages, boosting purchasing power and supporting demand for housing. Conversely, economic downturns can lead to job losses and reduced demand.

- Inflation: High inflation erodes purchasing power, impacting affordability and potentially dampening demand. However, it can also drive up construction costs, potentially pushing prices higher.

- Demographics: Shifting demographics, such as an aging population and changing family structures, can influence housing preferences and demand. For instance, a growing population of seniors might drive demand for retirement communities.

- Inventory: The availability of housing units significantly impacts prices. Limited inventory can push prices up, while a surplus can lead to price declines.

- Technology: Technological advancements, such as online platforms for property searches and virtual tours, are changing how people buy and sell homes. This can potentially impact pricing dynamics and market transparency.

- Environmental Factors: Climate change and its impact on coastal areas, natural disasters, and energy efficiency are becoming increasingly important considerations for real estate investors and buyers.

Exploring Potential Scenarios

Given the complexity of the factors at play, it’s useful to consider potential scenarios for price trends real estate 2025:

- Scenario 1: Moderate Growth: A moderate economic growth scenario, with stable interest rates and controlled inflation, could lead to gradual price appreciation in most markets. However, this growth might be slower than the recent years, reflecting a more balanced market.

- Scenario 2: Price Stabilization: If economic growth slows down, interest rates rise significantly, and inflation remains elevated, the market could experience price stabilization or even modest declines in some regions.

- Scenario 3: Regional Variations: It’s important to remember that real estate markets are not monolithic. Price trends can vary significantly across different regions, influenced by local factors like job growth, infrastructure development, and population shifts.

Regional Considerations

Price trends real estate 2025 will likely be influenced by regional factors. Areas with strong job markets, growing populations, and attractive amenities are likely to see continued price appreciation. However, regions experiencing economic decline or facing challenges like affordability or infrastructure issues could see slower growth or even price declines.

Emerging Trends

Several emerging trends are likely to shape price trends real estate 2025:

- Sustainable Housing: Demand for energy-efficient, sustainable homes is growing, driven by environmental concerns and rising energy costs. This trend could lead to premium pricing for green buildings and sustainable features.

- Remote Work: The rise of remote work is changing housing preferences, with increased demand for suburban or rural properties offering more space and privacy.

- Multigenerational Living: As life expectancies increase, multigenerational households are becoming more common. This trend could drive demand for larger homes with multi-generational living spaces.

- Affordable Housing Crisis: The growing affordability crisis, particularly in major cities, is prompting innovative solutions, such as micro-units, co-living spaces, and community land trusts.

Related Searches

Understanding price trends real estate 2025 requires exploring related searches that provide deeper insights into the market:

- Real Estate Market Forecast 2025: This search provides a comprehensive overview of the overall market outlook, including predictions for price trends, inventory, and demand.

- Housing Market Predictions 2025: This search focuses on specific predictions for the housing market, including the impact of factors like interest rates and inflation.

- Real Estate Investment Trends 2025: This search explores investment trends in real estate, including popular asset classes, investment strategies, and potential returns.

- Real Estate Market Analysis 2025: This search provides a detailed analysis of the current market conditions and their potential impact on future price trends.

- Future of Real Estate 2025: This search explores long-term trends and technological advancements that could shape the future of real estate.

- Real Estate Bubble 2025: This search investigates the potential for a real estate bubble, considering factors like overvaluation and market speculation.

- Real Estate Crash 2025: This search explores the possibility of a real estate market crash, considering potential triggers and their impact.

- Real Estate Market Outlook 2025: This search offers a comprehensive view of the market outlook, incorporating various factors and potential scenarios.

FAQs

Q: What are the biggest factors impacting real estate prices in 2025?

A: The biggest factors impacting real estate prices in 2025 will likely be interest rates, economic growth, inflation, and demographic shifts. These factors can influence demand, affordability, and the overall market dynamics.

Q: Will real estate prices continue to rise in 2025?

A: Predicting exact price movements is impossible. However, a moderate economic growth scenario with stable interest rates could lead to gradual price appreciation in most markets. However, price stabilization or even modest declines in some regions are possible if economic growth slows down, interest rates rise significantly, and inflation remains elevated.

Q: Are there any specific regions likely to see significant price increases in 2025?

A: Regions with strong job markets, growing populations, and attractive amenities are likely to see continued price appreciation. However, it’s essential to consider local factors and potential risks.

Q: What are the biggest risks to the real estate market in 2025?

A: The biggest risks to the real estate market in 2025 include a significant economic downturn, sharp increases in interest rates, uncontrolled inflation, and a potential real estate bubble.

Q: What are the potential benefits of investing in real estate in 2025?

A: Real estate can provide a hedge against inflation, generate rental income, and offer potential for long-term appreciation. However, it’s crucial to conduct thorough research and consider potential risks before making any investment decisions.

Tips for Navigating the Market

- Stay Informed: Stay up-to-date on market trends, economic indicators, and policy changes that could impact real estate prices.

- Seek Professional Advice: Consult with a real estate professional, such as a realtor or financial advisor, to gain insights and guidance.

- Consider Your Financial Situation: Evaluate your financial resources and affordability before making any real estate decisions.

- Diversify Your Investments: Don’t put all your eggs in one basket. Consider diversifying your investments across different asset classes.

- Be Patient and Strategic: The real estate market can be cyclical. Be patient and strategic in your approach, focusing on long-term goals.

Conclusion

Forecasting price trends real estate 2025 is a complex exercise involving numerous variables. While predicting exact figures is impossible, a comprehensive analysis of current market conditions, economic indicators, and emerging trends can shed light on potential scenarios. By understanding the factors at play, exploring potential scenarios, and staying informed about emerging trends, individuals and investors can navigate the real estate market with greater clarity and make informed decisions.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Uncharted Waters: Forecasting Real Estate Price Trends in 2025. We appreciate your attention to our article. See you in our next article!