Navigating The Future: Understanding Interest Rate Trends In 2025

Navigating the Future: Understanding Interest Rate Trends in 2025

Navigating the Future: Understanding Interest Rate Trends in 2025

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Navigating the Future: Understanding Interest Rate Trends in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Future: Understanding Interest Rate Trends in 2025

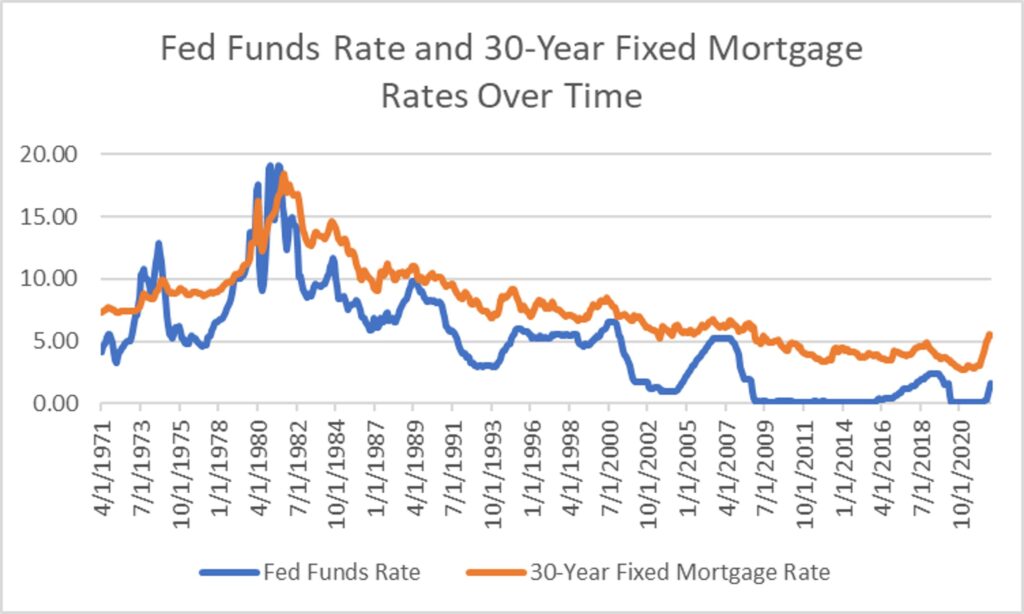

Predicting the future is an inherently complex task, and the realm of finance is no exception. However, by analyzing current trends and historical data, we can gain valuable insights into the potential trajectory of interest rates in 2025. This understanding is crucial for individuals and businesses alike, as interest rates significantly impact borrowing costs, investment returns, and overall economic activity.

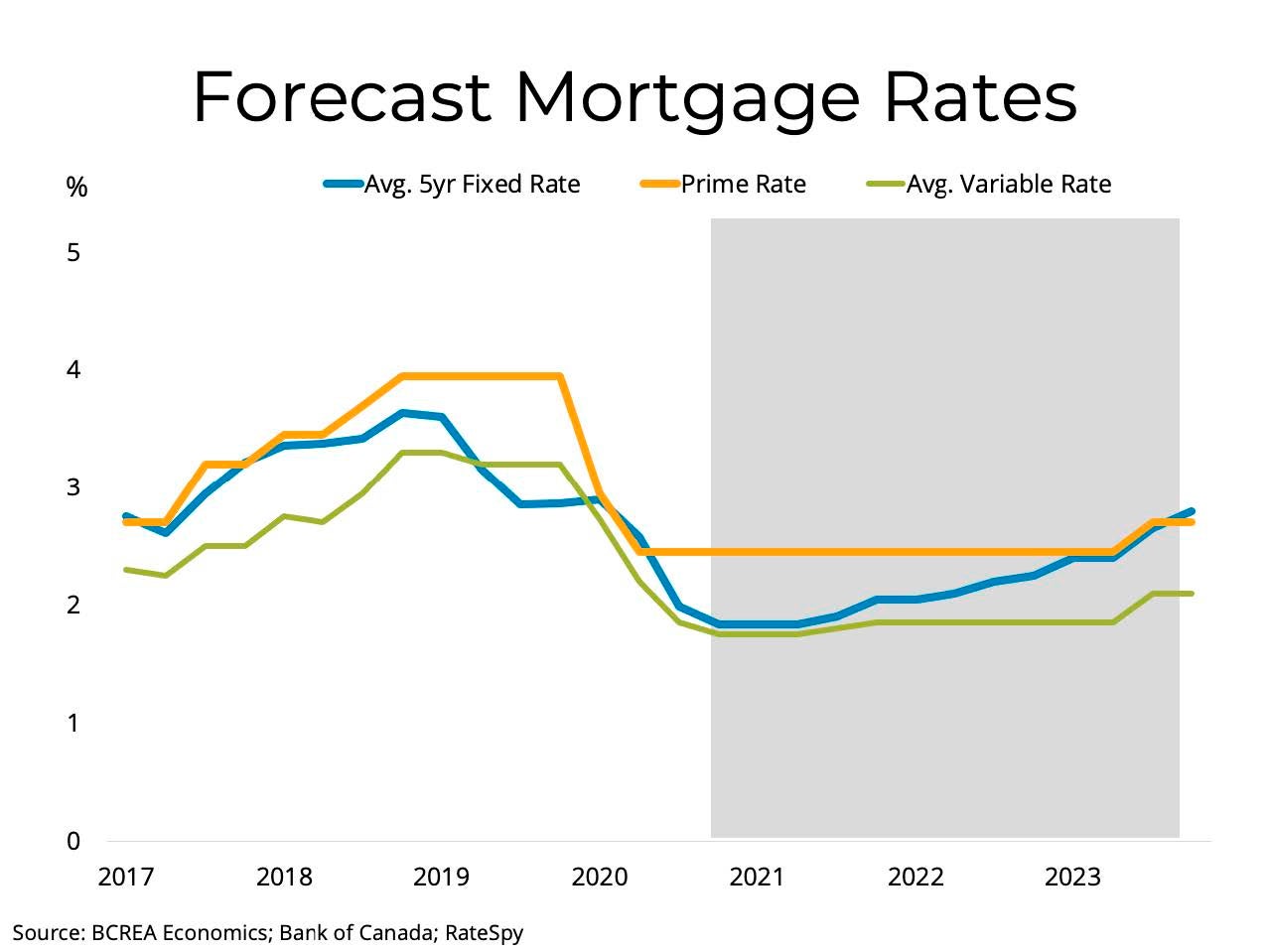

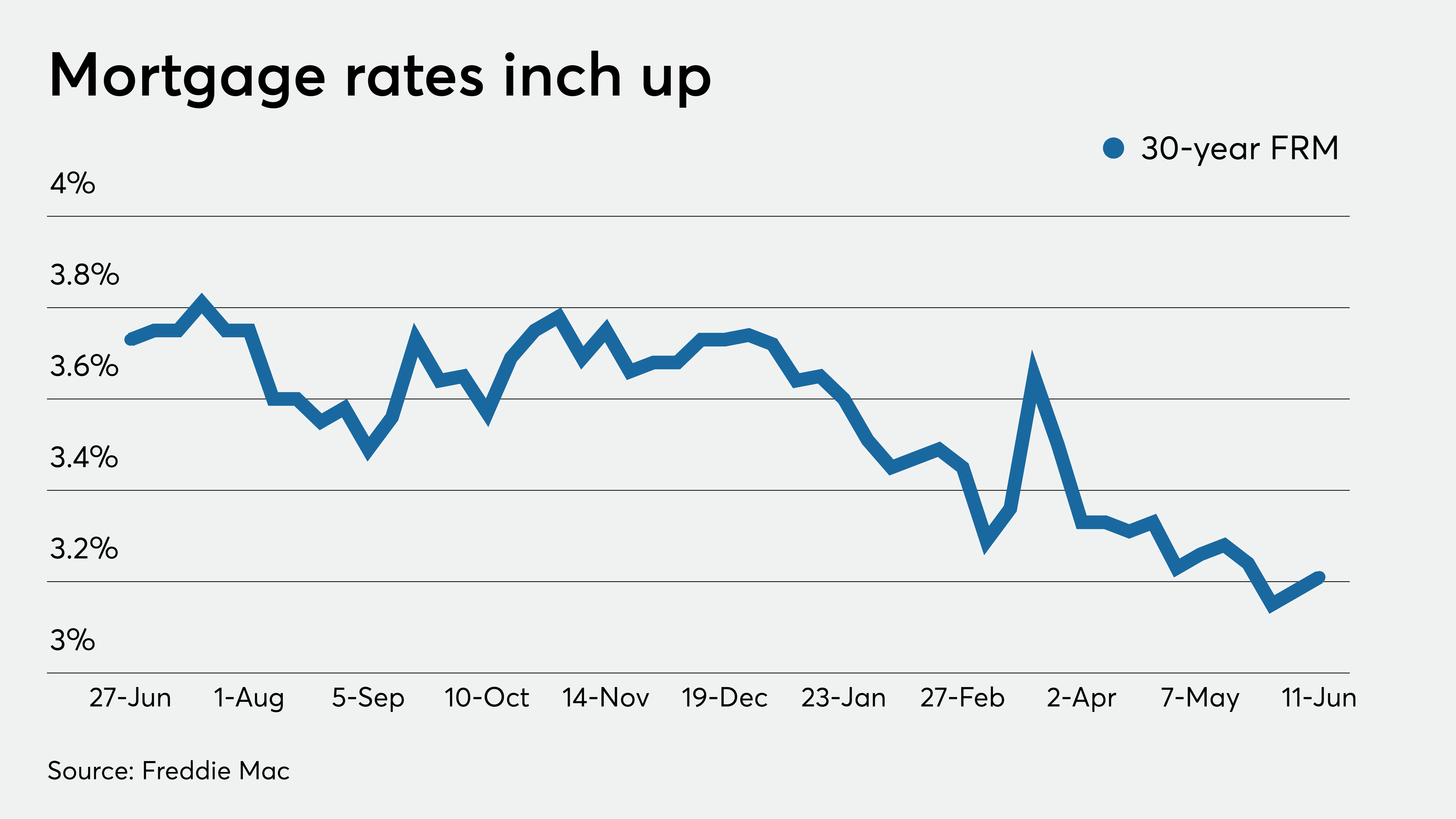

Interest rate trends graph 2025 represents a visual representation of projected interest rate movements over the next few years. While precise predictions are impossible, the graph serves as a valuable tool for understanding the potential range of outcomes and their implications.

Factors Influencing Interest Rate Trends

The direction of interest rates is determined by a complex interplay of economic factors, including:

- Inflation: When prices rise rapidly, central banks often raise interest rates to curb spending and cool down the economy. Conversely, low inflation may lead to lower interest rates to stimulate economic growth.

- Economic Growth: Strong economic growth can lead to higher interest rates as investors anticipate higher returns. Conversely, weak economic growth may necessitate lower interest rates to encourage borrowing and spending.

- Government Policies: Fiscal and monetary policies implemented by governments and central banks directly influence interest rates. For example, quantitative easing programs can lower interest rates, while tax cuts can stimulate economic growth and potentially lead to higher rates.

- Global Economic Conditions: International events, such as global recessions or geopolitical tensions, can significantly impact interest rates. For instance, a global economic slowdown may lead to lower interest rates as countries attempt to stimulate their economies.

- Market Sentiment: Investor confidence and expectations about future economic conditions can influence interest rate movements. For example, if investors anticipate a strong economy, they may demand higher interest rates on their investments.

Interpreting the Interest Rate Trends Graph 2025

The interest rate trends graph 2025 typically presents a range of possible scenarios based on different assumptions about the underlying economic factors.

- Scenario 1: Continued Economic Growth: If the economy continues to grow at a healthy pace, with inflation remaining within the desired range, interest rates may rise gradually. This scenario suggests a positive outlook for businesses and investors, with potentially higher returns on investments and increased borrowing opportunities.

- Scenario 2: Economic Slowdown: If the economy experiences a slowdown, potentially due to factors like global trade tensions or rising energy prices, interest rates may remain low or even decline. This scenario could create challenges for businesses and investors, as borrowing costs may remain high, and investment returns may be limited.

- Scenario 3: Inflationary Pressure: If inflation rises significantly, central banks may aggressively raise interest rates to curb spending and bring inflation under control. This scenario could lead to higher borrowing costs for businesses and individuals, potentially impacting economic growth.

Understanding the Importance of Interest Rate Trends Graph 2025

The interest rate trends graph 2025 is crucial for various stakeholders:

- Individuals: Understanding interest rate trends can help individuals make informed financial decisions, such as choosing the right mortgage, optimizing savings strategies, or investing in assets that may benefit from rising or falling interest rates.

- Businesses: Businesses rely on interest rate trends to make strategic decisions regarding borrowing, investment, and pricing. For example, businesses may choose to invest in projects with higher returns if interest rates are expected to rise.

- Investors: Investors use interest rate trends to assess the potential returns on different asset classes, such as bonds, stocks, and real estate. For instance, rising interest rates may make bonds less attractive, while stocks may perform better in a low-interest rate environment.

- Governments and Central Banks: Central banks use interest rate trends to monitor economic activity and adjust monetary policy accordingly. For example, if inflation is rising, central banks may raise interest rates to cool down the economy.

Related Searches

Understanding interest rate trends graph 2025 also requires exploring related searches that offer further insights into the broader economic context:

- Federal Reserve Interest Rate Projections: The Federal Reserve, the central bank of the United States, releases interest rate projections known as the "dot plot." These projections provide insights into the Fed’s outlook for future interest rate movements and can influence market expectations.

- Inflation Rate Projections 2025: Understanding the projected trajectory of inflation is crucial for assessing the likelihood of interest rate changes. Higher inflation typically leads to higher interest rates, while lower inflation may result in lower rates.

- Economic Growth Forecasts 2025: Economic growth forecasts provide insights into the overall health of the economy, which can influence interest rate trends. Strong economic growth may lead to higher interest rates, while weak growth may necessitate lower rates.

- Global Interest Rate Trends 2025: Interest rates are interconnected globally, and changes in one country can impact rates in others. Understanding global interest rate trends provides a broader context for assessing domestic rate movements.

- Bond Yield Curve: The bond yield curve represents the relationship between interest rates and maturities for bonds. The shape of the yield curve can provide insights into market expectations for future interest rate movements.

- Mortgage Interest Rates 2025: Mortgage interest rates are particularly sensitive to changes in broader interest rates. Understanding projected mortgage rates is essential for individuals planning to buy or refinance a home.

- Interest Rate Risk: Interest rate risk refers to the potential for changes in interest rates to negatively impact investment returns. Understanding interest rate risk is crucial for investors, especially those holding fixed-income securities.

- Interest Rate Policy: Central banks use interest rate policy as a primary tool for managing inflation and promoting economic growth. Understanding interest rate policy helps investors and businesses make informed decisions based on central bank actions.

FAQs

1. What are the key factors driving interest rate trends in 2025?

The key factors driving interest rate trends in 2025 include inflation, economic growth, government policies, global economic conditions, and market sentiment.

2. How can I use the interest rate trends graph 2025 to make informed financial decisions?

The interest rate trends graph 2025 can help you assess potential future interest rate movements and make informed decisions regarding borrowing, saving, and investing. For example, if you anticipate rising interest rates, you may want to lock in a lower interest rate on a mortgage or consider investing in assets that may benefit from higher rates.

3. What are the potential implications of rising interest rates in 2025?

Rising interest rates can lead to higher borrowing costs for businesses and individuals, potentially slowing economic growth. However, higher rates can also attract foreign investment and increase returns on savings.

4. What are the potential implications of falling interest rates in 2025?

Falling interest rates can stimulate borrowing and spending, potentially boosting economic growth. However, lower rates can also lead to lower returns on savings and potentially increase inflation.

5. How can I stay informed about interest rate trends in 2025?

You can stay informed about interest rate trends by following financial news, reading economic reports, and consulting with financial advisors.

Tips

- Stay informed: Regularly monitor economic news, central bank announcements, and market reports to stay updated on interest rate trends.

- Diversify investments: Diversifying your investment portfolio across different asset classes can help mitigate interest rate risk.

- Review financial plans: Regularly review your financial plans to ensure they are aligned with your current financial goals and anticipated interest rate movements.

- Consult with financial advisors: Seeking advice from financial advisors can help you develop a personalized strategy for navigating interest rate trends.

Conclusion

The interest rate trends graph 2025 provides a valuable tool for understanding the potential trajectory of interest rates in the coming years. While precise predictions are impossible, the graph helps to visualize potential scenarios and their implications for individuals, businesses, and the overall economy. By carefully considering the factors influencing interest rate movements and staying informed about current trends, stakeholders can make informed decisions to navigate the future financial landscape.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Future: Understanding Interest Rate Trends in 2025. We hope you find this article informative and beneficial. See you in our next article!