Navigating The Future: Trends Shaping The Insurance Industry In 2025

Navigating the Future: Trends Shaping the Insurance Industry in 2025

Navigating the Future: Trends Shaping the Insurance Industry in 2025

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Future: Trends Shaping the Insurance Industry in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Future: Trends Shaping the Insurance Industry in 2025

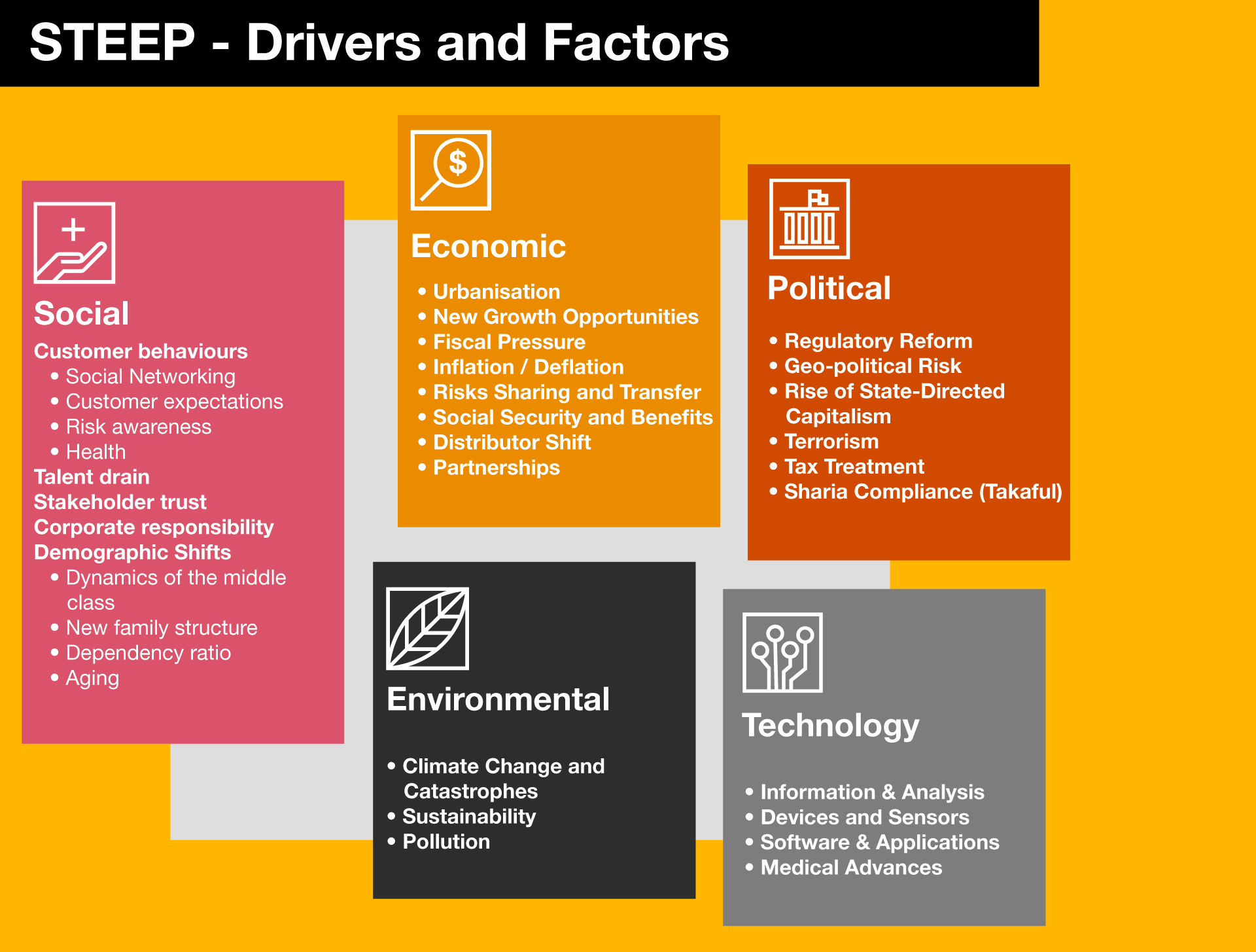

The insurance landscape is undergoing a rapid transformation, driven by technological advancements, evolving consumer expectations, and a changing global landscape. As we approach 2025, several key trends will continue to reshape the industry, impacting both insurers and policyholders.

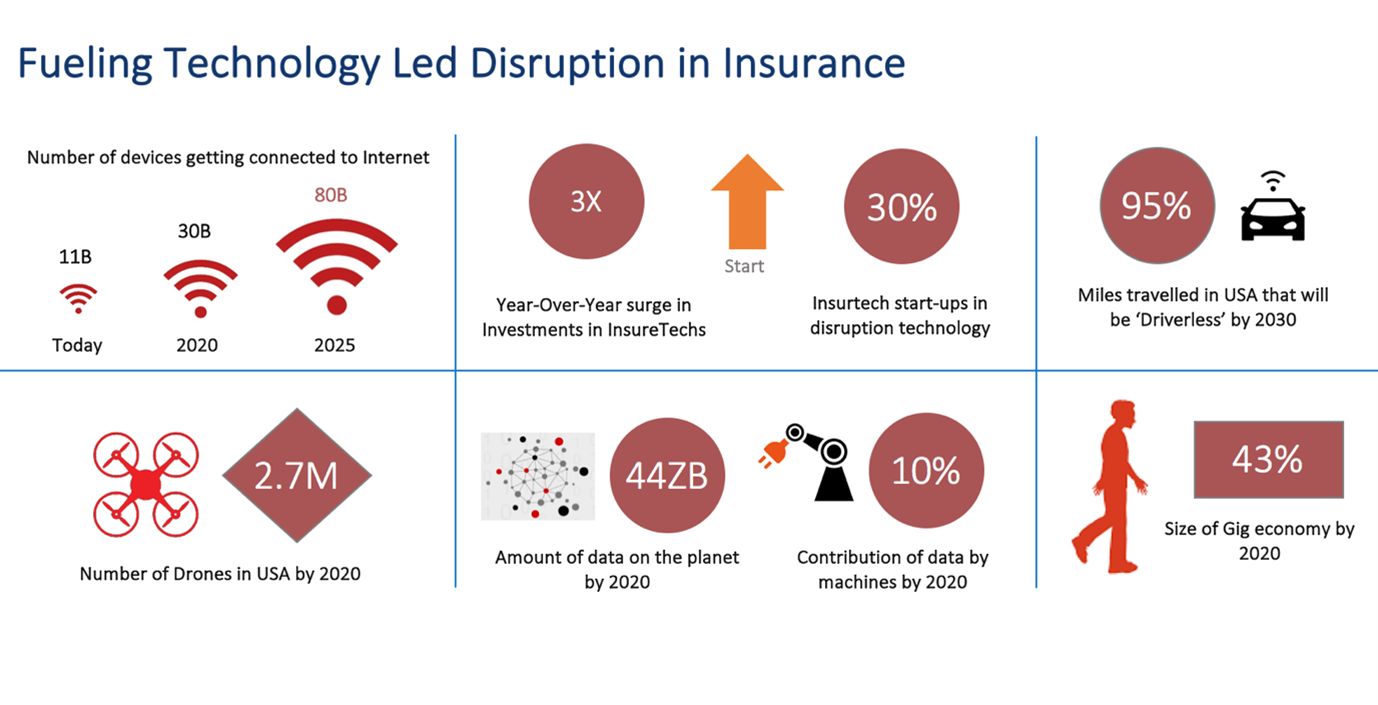

1. The Rise of Insurtech:

Insurtech, the convergence of insurance and technology, is revolutionizing the industry. Startups and established players are leveraging technologies like artificial intelligence (AI), machine learning (ML), blockchain, and big data analytics to create innovative solutions for insurance needs.

Benefits of Insurtech:

- Enhanced Customer Experience: Insurtech companies offer personalized experiences, streamlined processes, and 24/7 accessibility through mobile apps and online platforms.

- Improved Risk Assessment: AI-powered algorithms can analyze vast datasets to assess risks more accurately, leading to more precise pricing and personalized policies.

- Faster Claims Processing: Automation and AI streamline claims processing, reducing wait times and improving customer satisfaction.

- New Product Development: Insurtech empowers the creation of innovative insurance products tailored to specific customer segments and emerging risks.

Examples of Insurtech Innovations:

- Usage-based insurance: Insurance premiums are calculated based on actual usage, rewarding safe driving habits or responsible energy consumption.

- Micro-insurance: Affordable, bite-sized insurance policies for specific needs, such as mobile phone insurance or travel insurance.

- On-demand insurance: Flexible coverage options that allow customers to purchase insurance only when needed, such as short-term rental insurance.

2. Hyper-Personalization and Customer-Centricity:

The insurance industry is shifting towards a customer-centric approach, focusing on understanding and meeting individual needs. This trend is fueled by the rise of digital natives who expect personalized experiences across all industries.

Key Aspects of Customer-Centricity:

- Data-Driven Insights: Insurers are leveraging customer data to create personalized offers, tailor communication, and provide relevant support.

- Seamless Digital Journeys: From online quotes to policy management and claims processing, insurers are creating seamless digital experiences for customers.

- Proactive Engagement: Insurers are moving beyond reactive customer service to proactively engage with policyholders, offering guidance and support before, during, and after claims.

- Personalized Communication: Insurers are using targeted communication channels and tailored messaging to reach customers effectively.

3. The Growing Importance of Data and Analytics:

Data is the lifeblood of the modern insurance industry. Insurers are collecting and analyzing vast amounts of data to gain insights into customer behavior, risk factors, and market trends.

Key Applications of Data Analytics in Insurance:

- Risk Modeling: Predictive analytics helps insurers assess risks more accurately, leading to more precise pricing and underwriting decisions.

- Fraud Detection: AI algorithms can identify patterns and anomalies in claims data, helping insurers prevent fraudulent activity.

- Customer Segmentation: Data analysis enables insurers to segment customers based on their needs, preferences, and risk profiles, allowing for targeted marketing and product development.

- Operational Efficiency: Data analytics can optimize internal processes, improve operational efficiency, and reduce costs.

4. The Rise of Digital Distribution Channels:

Traditional insurance distribution channels are being challenged by the rise of digital platforms. Online brokers, aggregators, and direct-to-consumer models are gaining popularity, providing customers with greater choice and convenience.

Benefits of Digital Distribution:

- Increased Accessibility: Digital platforms make insurance products accessible to a wider audience, breaking down geographical barriers.

- Enhanced Transparency: Online platforms provide customers with easy access to information about different insurance products and their features.

- Simplified Comparison: Online tools allow customers to compare quotes from multiple insurers, making it easier to find the best value.

- Improved Customer Experience: Digital platforms offer a more efficient and convenient way to purchase and manage insurance policies.

5. The Impact of Climate Change and Sustainability:

The growing awareness of climate change is impacting the insurance industry in significant ways. Insurers are facing increased risks from natural disasters, while policyholders are seeking coverage for climate-related events.

Key Considerations for Climate Change in Insurance:

- Increased Risk Assessment: Insurers need to adapt their risk assessment models to account for climate change-related risks, such as rising sea levels and extreme weather events.

- Product Development: Insurers are developing new products and services to address climate-related risks, such as parametric insurance, which pays out based on specific weather events.

- Sustainable Practices: Insurers are adopting sustainable practices in their own operations, reducing their environmental footprint and supporting climate-friendly initiatives.

6. The Importance of Cybersecurity:

As the insurance industry becomes increasingly reliant on technology, cybersecurity is a critical concern. Data breaches and cyberattacks can have devastating consequences for insurers and their customers.

Key Cybersecurity Measures for Insurers:

- Strong Security Infrastructure: Insurers need to invest in robust cybersecurity infrastructure, including firewalls, intrusion detection systems, and data encryption.

- Employee Training: Employees must be trained to recognize and avoid phishing scams and other cyber threats.

- Incident Response Plans: Insurers need to have comprehensive incident response plans in place to address cyberattacks effectively.

- Data Privacy Compliance: Insurers must comply with data privacy regulations, such as GDPR, to protect customer information.

7. The Growth of Artificial Intelligence (AI) and Machine Learning (ML):

AI and ML are transforming the insurance industry, automating tasks, improving decision-making, and enhancing customer experiences.

Applications of AI and ML in Insurance:

- Underwriting: AI-powered algorithms can analyze vast datasets to assess risk profiles more accurately and automate underwriting processes.

- Claims Processing: AI can automate claims processing, reducing wait times and improving customer satisfaction.

- Fraud Detection: AI algorithms can identify patterns and anomalies in claims data, helping insurers detect fraudulent activity.

- Customer Service: AI-powered chatbots can provide 24/7 customer support, answering questions and resolving issues.

8. The Rise of the Sharing Economy:

The sharing economy is impacting the insurance industry, with new models emerging to address the unique risks associated with sharing assets and services.

Insurance Needs in the Sharing Economy:

- Peer-to-peer insurance: Platforms that allow individuals to insure each other directly, reducing costs and increasing transparency.

- On-demand insurance: Flexible coverage options that allow individuals to purchase insurance only when needed, such as short-term rental insurance.

- Usage-based insurance: Insurance premiums are calculated based on actual usage, rewarding safe driving habits or responsible energy consumption.

FAQs by Trends in the Insurance Industry 2025

Q1: How will these trends impact insurance premiums?

A: The trends outlined above are likely to lead to more personalized and dynamic pricing models. Insurers will leverage data and analytics to assess risk more accurately, potentially leading to more competitive premiums for low-risk individuals. However, those with higher risk profiles may see premium increases.

Q2: Will these trends make insurance more accessible?

A: The rise of Insurtech and digital distribution channels will make insurance more accessible to a wider audience. Micro-insurance products and on-demand insurance options will provide affordable coverage for specific needs.

Q3: What are the challenges facing the insurance industry in adapting to these trends?

A: The insurance industry faces challenges in adapting to these trends, including:

- Keeping pace with technological advancements: Insurers need to invest in technology and talent to keep pace with the rapid evolution of Insurtech.

- Data security and privacy: Insurers need to ensure the security and privacy of customer data, which is essential for building trust and maintaining compliance.

- Regulatory landscape: The regulatory landscape is constantly evolving, and insurers need to adapt to new rules and regulations.

- Talent acquisition: Insurers need to attract and retain skilled professionals with expertise in technology, data analytics, and customer experience.

Tips by Trends in the Insurance Industry 2025

- Embrace Technology: Insurers need to embrace technology and invest in digital transformation to stay competitive.

- Focus on Customer Experience: Insurers need to prioritize customer experience, offering personalized solutions and seamless digital journeys.

- Leverage Data and Analytics: Insurers need to harness the power of data and analytics to improve decision-making, optimize operations, and personalize offerings.

- Stay Informed About Trends: Insurers need to stay informed about emerging trends in the industry and adapt their strategies accordingly.

Conclusion by Trends in the Insurance Industry 2025

The insurance industry is on the cusp of a significant transformation. The trends outlined above will reshape the industry, creating new opportunities for innovation, efficiency, and customer-centricity. Insurers who embrace these trends and adapt to the changing landscape will be well-positioned for success in the years to come. By focusing on technology, customer experience, data analytics, and sustainability, insurers can navigate the future of the insurance industry and create value for their customers and stakeholders.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Future: Trends Shaping the Insurance Industry in 2025. We appreciate your attention to our article. See you in our next article!