Navigating The Future: Macroeconomic Trends Shaping 2025

Navigating the Future: Macroeconomic Trends Shaping 2025

Navigating the Future: Macroeconomic Trends Shaping 2025

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Future: Macroeconomic Trends Shaping 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Navigating the Future: Macroeconomic Trends Shaping 2025

- 2 Introduction

- 3 Navigating the Future: Macroeconomic Trends Shaping 2025

- 3.1 The Big Picture: Key Macroeconomic Trends Shaping 2025

- 3.2 Related Searches:

- 3.3 FAQs:

- 3.4 Tips for Navigating Macroeconomic Trends in 2025:

- 3.5 Conclusion:

- 4 Closure

Navigating the Future: Macroeconomic Trends Shaping 2025

The world economy is a complex and constantly evolving system. Understanding the key macroeconomic trends driving its trajectory is crucial for individuals, businesses, and governments alike. This article delves into the major forces shaping the global landscape in 2025, offering a comprehensive analysis of their potential impacts and implications.

The Big Picture: Key Macroeconomic Trends Shaping 2025

1. Persistent Inflation: While inflation rates may moderate from their recent highs, the expectation is that they will remain elevated compared to historical norms. This persistent inflation will be fueled by factors such as supply chain disruptions, labor shortages, and the ongoing energy crisis.

- Impact: Consumers will face higher costs for goods and services, potentially leading to reduced purchasing power and a dampening effect on economic growth. Businesses will need to navigate price increases and adjust pricing strategies to maintain profitability. Governments will be tasked with balancing inflation control with economic growth through fiscal and monetary policies.

2. Interest Rate Hikes: Central banks around the world are aggressively raising interest rates to combat inflation. This tightening of monetary policy aims to cool down economic activity by making borrowing more expensive and discouraging investment.

- Impact: Businesses may face higher borrowing costs, potentially slowing down investment and expansion plans. Consumers may experience a decrease in disposable income due to higher mortgage rates and loan repayments. The housing market could witness a slowdown, with potential price corrections in some regions.

3. Geopolitical Uncertainty: The global landscape is marked by heightened geopolitical tensions, including the ongoing Russia-Ukraine conflict and the increasing rivalry between the United States and China. This uncertainty creates volatility in global markets and can disrupt trade and investment flows.

- Impact: Businesses may face supply chain disruptions, increased costs for raw materials, and potential sanctions. Investors might become more risk-averse, leading to decreased capital flows to emerging markets. Governments need to navigate complex international relations and potentially face increased defense spending.

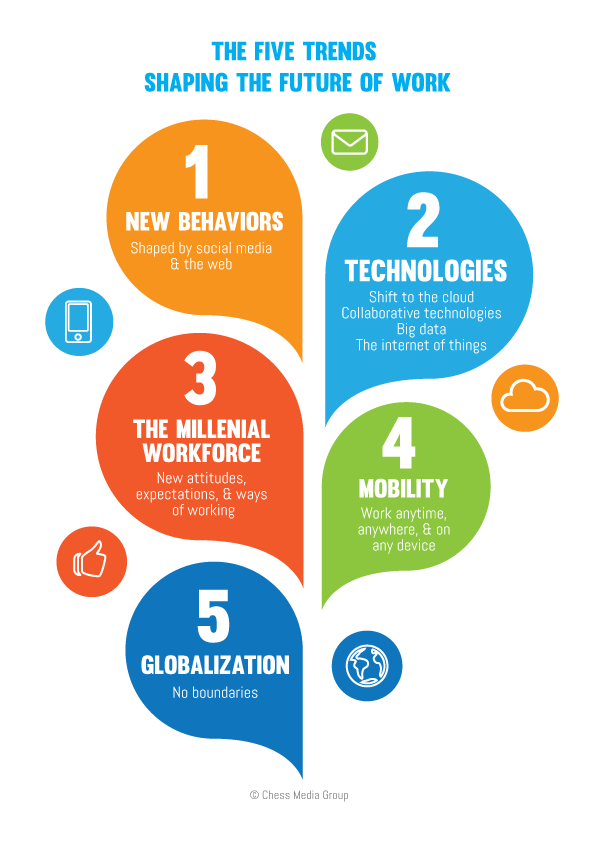

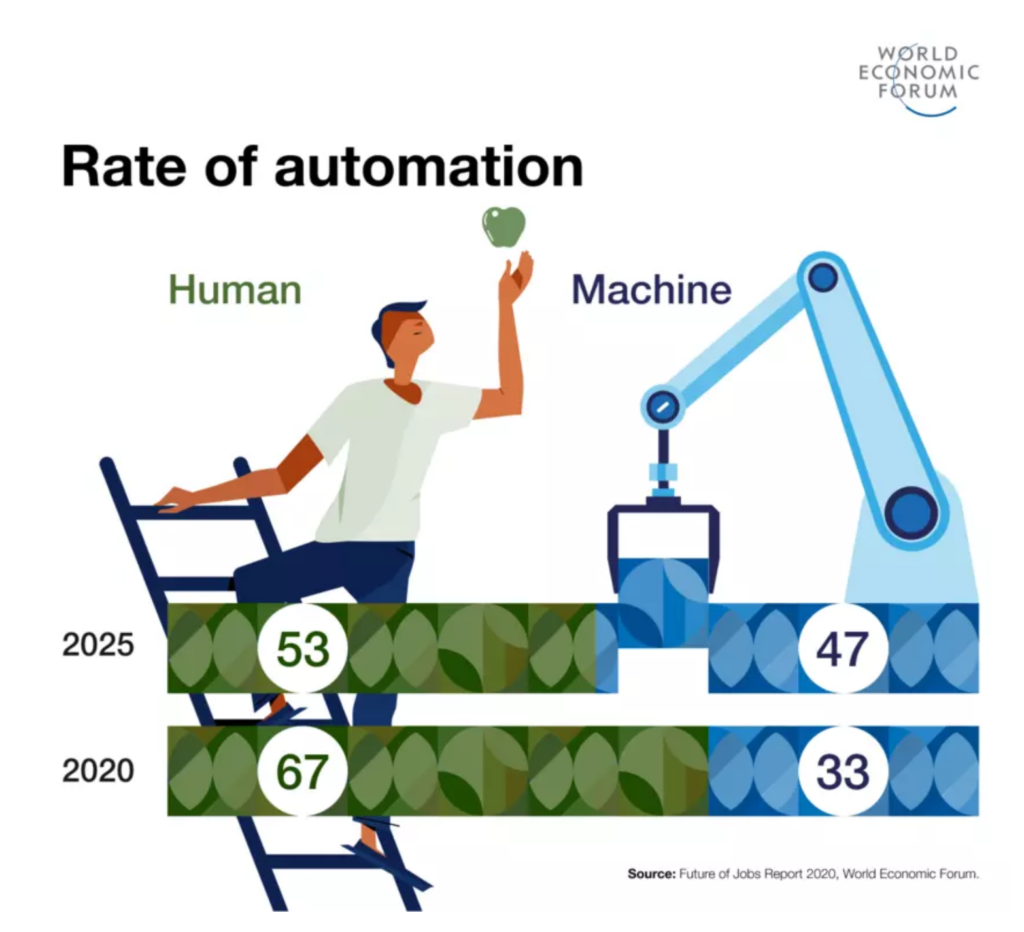

4. Technological Advancements: Artificial intelligence (AI), automation, and digitalization continue to reshape industries, creating new opportunities and challenges. These technological advancements can boost productivity, create new jobs, and drive economic growth. However, they also pose risks of job displacement and widening inequality.

- Impact: Businesses will need to adapt to technological advancements, investing in new technologies and reskilling their workforce. Governments will face the challenge of managing the transition to a more automated economy, ensuring equitable access to education and training opportunities.

5. Climate Change: The effects of climate change are becoming increasingly evident, posing significant risks to economies and societies. Extreme weather events, rising sea levels, and resource scarcity are already impacting agriculture, infrastructure, and human health.

- Impact: Businesses will need to adopt sustainable practices and invest in climate-resilient infrastructure. Governments will need to implement policies that promote a transition to a low-carbon economy, including carbon pricing mechanisms and investments in renewable energy.

6. Demographic Shifts: Global populations are aging, with implications for labor markets, healthcare systems, and consumption patterns. The shrinking workforce in developed countries could lead to labor shortages and potentially slower economic growth.

- Impact: Businesses will need to adapt to an aging workforce, potentially offering more flexible work arrangements and focusing on retaining experienced employees. Governments will need to address the challenges of an aging population, including reforming pension systems and providing adequate healthcare services.

7. Rising Debt Levels: Many countries and corporations are facing high levels of debt, making them vulnerable to economic shocks and interest rate hikes. This growing debt burden can hinder economic growth and potentially lead to financial instability.

- Impact: Governments will need to manage their debt levels and implement policies to promote sustainable economic growth. Businesses will need to carefully manage their financial leverage and explore ways to reduce debt.

8. Emerging Market Growth: Despite global economic challenges, emerging markets are expected to continue growing at a faster pace than developed economies. This growth will be driven by factors such as rising middle-class populations, increasing urbanization, and technological advancements.

- Impact: Businesses can tap into the growing consumer markets in emerging economies, but they need to understand the unique characteristics of these markets and adapt their products and services accordingly. Investors can seek opportunities in emerging markets but need to be aware of the associated risks.

Related Searches:

1. Global Economic Outlook 2025: This search explores predictions and forecasts for global economic growth, inflation, and other key macroeconomic indicators in 2025. It may also delve into the potential impact of various factors, such as geopolitical tensions, climate change, and technological advancements, on the global economy.

2. Macroeconomic Trends in Emerging Markets: This search focuses on the specific macroeconomic trends driving economic growth and development in emerging markets. It may analyze factors such as rising middle-class populations, urbanization, and technological adoption, as well as the challenges and opportunities these trends present.

3. Impact of Inflation on Businesses: This search examines the impact of persistent inflation on businesses, exploring topics such as pricing strategies, cost management, and supply chain resilience. It may also discuss the challenges of navigating a high-inflation environment and the potential impact on profitability and investment decisions.

4. Monetary Policy in 2025: This search explores the anticipated monetary policy stance of central banks in 2025, including interest rate levels, quantitative easing, and other tools used to control inflation and stimulate economic growth. It may also analyze the potential impact of monetary policy decisions on various sectors of the economy.

5. Technological Disruption in 2025: This search delves into the expected impact of technological advancements, such as artificial intelligence, automation, and digitalization, on various industries and sectors in 2025. It may explore topics such as job creation and displacement, productivity gains, and the potential for economic growth and disruption.

6. Climate Change and the Economy: This search focuses on the economic implications of climate change, including the impact on industries, infrastructure, and human health. It may also explore the potential costs of climate change mitigation and adaptation, as well as the opportunities for sustainable economic growth.

7. Demographic Trends and Economic Growth: This search examines the impact of demographic shifts, such as aging populations and declining birth rates, on economic growth and development. It may analyze the challenges of maintaining a healthy and productive workforce, as well as the potential impact on healthcare systems and consumption patterns.

8. Global Debt Levels in 2025: This search explores the anticipated levels of global debt in 2025, including the risks and challenges posed by high debt levels. It may also examine the impact of debt on economic growth, financial stability, and government policy decisions.

FAQs:

Q: What are the main drivers of persistent inflation in 2025?

A: Several factors contribute to persistent inflation in 2025, including:

- Supply chain disruptions: The global supply chain remains fragile due to factors like the pandemic, geopolitical tensions, and natural disasters, leading to shortages and price increases.

- Labor shortages: Many countries are experiencing labor shortages, leading to wage pressures and higher costs for businesses.

- Energy crisis: The ongoing energy crisis, driven by factors like the Russia-Ukraine conflict and increased demand, has led to soaring energy prices, impacting inflation across various sectors.

- Government stimulus: The massive government stimulus packages implemented during the pandemic have also contributed to inflationary pressures.

Q: How will rising interest rates affect the housing market in 2025?

A: Rising interest rates are likely to have a significant impact on the housing market in 2025, potentially leading to:

- Reduced affordability: Higher mortgage rates will make it more expensive for buyers to finance homes, potentially reducing demand and slowing down price growth.

- Slowdown in sales: The combination of higher interest rates and reduced affordability may lead to a decline in home sales.

- Price corrections: In some regions, particularly those with overheated housing markets, prices could experience a correction as demand weakens.

- Increased rental demand: As homeownership becomes less affordable, there could be an increase in demand for rental properties.

Q: What are the potential benefits of technological advancements in 2025?

A: Technological advancements can bring significant benefits to the global economy, including:

- Increased productivity: Automation and AI can enhance efficiency and boost productivity across various industries.

- Job creation: New technologies can create new jobs in sectors like software development, data analysis, and artificial intelligence.

- Improved healthcare: Technological advancements can lead to breakthroughs in healthcare, improving diagnostics, treatments, and overall health outcomes.

- Enhanced sustainability: Technologies like renewable energy and smart grids can contribute to a more sustainable and environmentally friendly future.

Q: What challenges does climate change pose for the global economy in 2025?

A: Climate change poses significant challenges for the global economy, including:

- Increased natural disasters: Extreme weather events, such as hurricanes, floods, and droughts, can cause widespread damage to infrastructure, agriculture, and businesses.

- Rising sea levels: Rising sea levels threaten coastal communities and infrastructure, leading to displacement and economic losses.

- Resource scarcity: Climate change can exacerbate resource scarcity, impacting food production, water availability, and energy security.

- Increased costs: Adapting to climate change and mitigating its effects can be expensive, requiring significant investments in renewable energy, resilient infrastructure, and disaster preparedness.

Q: How can governments manage the challenges of an aging population in 2025?

A: Governments can address the challenges of an aging population by:

- Reforming pension systems: Ensuring the long-term sustainability of pension systems by adjusting benefits and contribution rates to account for demographic changes.

- Providing adequate healthcare services: Investing in healthcare infrastructure and services to meet the growing demand from an aging population.

- Promoting active aging: Encouraging older adults to remain engaged in the workforce and society, through policies that support flexible work arrangements and lifelong learning opportunities.

- Supporting family caregivers: Providing support to family members who care for elderly relatives, including financial assistance, respite care, and training.

Q: What are the key risks associated with high debt levels in 2025?

A: High debt levels pose several risks to the global economy, including:

- Financial instability: High debt levels can make countries and businesses more vulnerable to economic shocks and interest rate hikes, potentially leading to financial crises.

- Slower economic growth: High debt burdens can weigh down economic growth by diverting resources away from investment and consumption.

- Reduced government flexibility: High debt levels can limit government flexibility to respond to economic crises or invest in infrastructure and social programs.

- Increased risk aversion: High debt levels can lead to increased risk aversion among investors, potentially reducing capital flows to emerging markets and hindering economic development.

Tips for Navigating Macroeconomic Trends in 2025:

- Stay informed: Stay up-to-date on the latest economic data, analysis, and forecasts. Follow reputable economic publications, research institutions, and central bank reports.

- Diversify investments: Spread your investments across different asset classes and sectors to reduce risk. Consider investing in emerging markets and sectors that are expected to benefit from long-term trends.

- Adapt to changing circumstances: Be prepared to adapt your business strategies and investment decisions in response to changing macroeconomic conditions.

- Embrace technological advancements: Invest in new technologies and reskill your workforce to remain competitive in a rapidly evolving technological landscape.

- Consider the impact of climate change: Incorporate climate change risks and opportunities into your business decisions, investing in sustainable practices and climate-resilient infrastructure.

- Engage in responsible lending and borrowing: Manage your debt levels carefully, and avoid taking on excessive debt that could jeopardize your financial stability.

- Support policies that promote economic growth and stability: Engage in political discourse and advocate for policies that support a healthy and sustainable economy.

Conclusion:

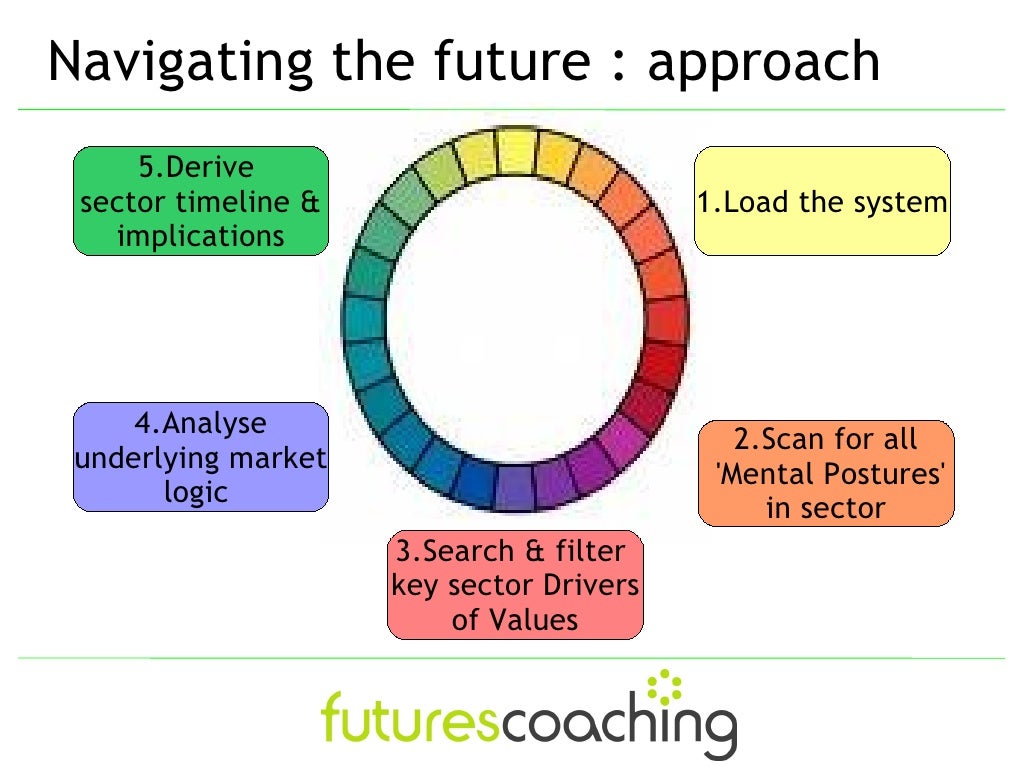

The macroeconomic landscape in 2025 will be shaped by a complex interplay of forces, presenting both challenges and opportunities. Navigating these trends effectively requires a deep understanding of the key drivers, potential impacts, and available strategies. By staying informed, adapting to change, and embracing innovation, individuals, businesses, and governments can position themselves for success in a dynamic and uncertain world.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Future: Macroeconomic Trends Shaping 2025. We appreciate your attention to our article. See you in our next article!