Navigating The Future: Investment Quality Trends In 2025

Navigating the Future: Investment Quality Trends in 2025

Navigating the Future: Investment Quality Trends in 2025

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Future: Investment Quality Trends in 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Future: Investment Quality Trends in 2025

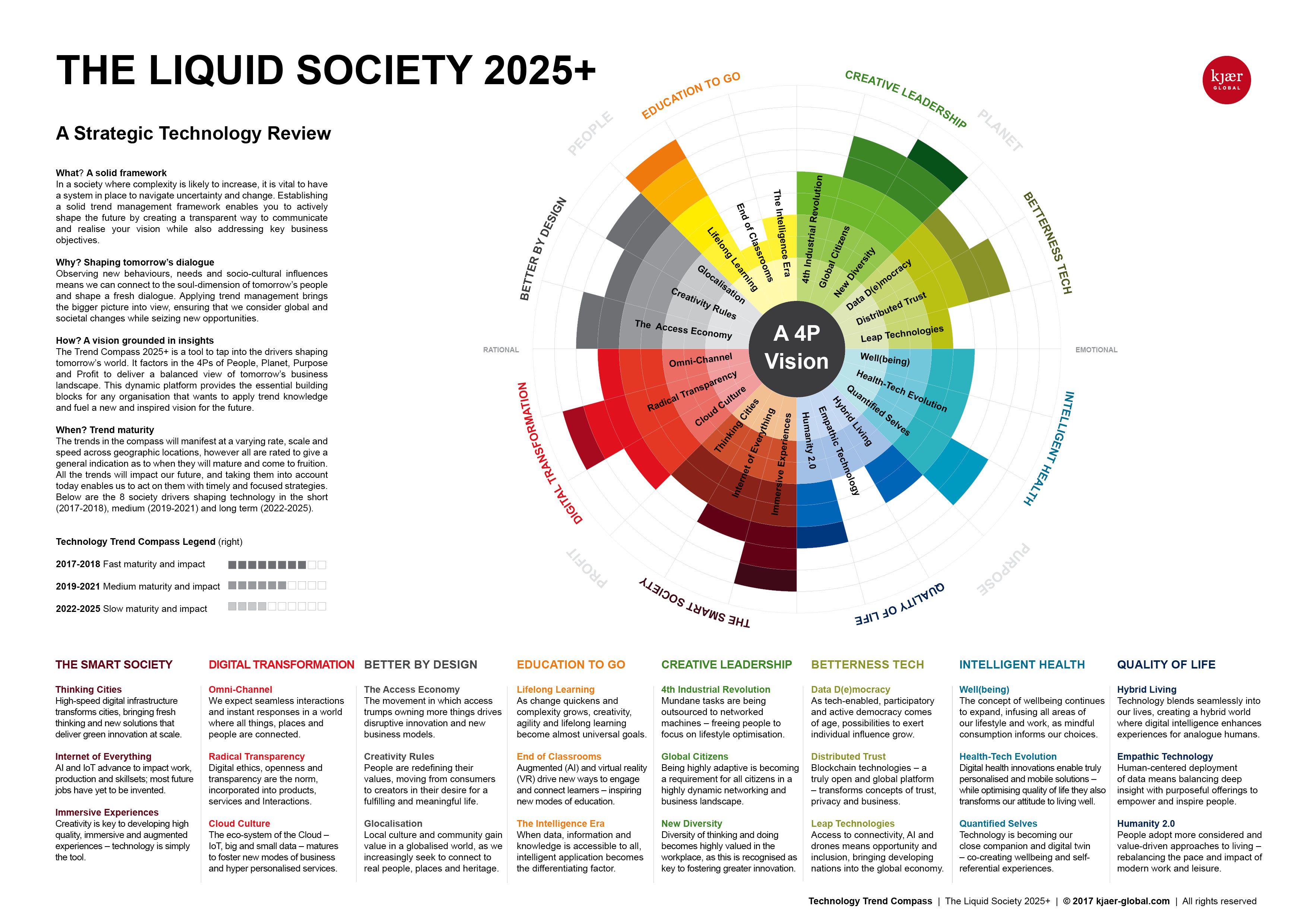

The landscape of investment is perpetually evolving, driven by technological advancements, geopolitical shifts, and evolving consumer preferences. As we approach 2025, several trends are shaping the landscape of investment quality, influencing how investors approach asset allocation, risk management, and portfolio construction. Understanding these trends is crucial for investors seeking to navigate the complexities of the future market and maximize returns.

Key Investment Quality Trends Shaping 2025

1. The Rise of Sustainable Investing:

Sustainability is no longer a niche concern; it is becoming the cornerstone of responsible investing. Investors are increasingly prioritizing companies demonstrating a commitment to environmental, social, and governance (ESG) principles. This trend is driven by a growing awareness of climate change, social inequality, and corporate accountability.

Understanding the Impact:

- Increased Demand for ESG-Focused Investments: Investors are demanding transparency and accountability from companies regarding their environmental impact, social responsibility, and governance practices. This demand is driving the growth of ESG-focused investment funds, ETFs, and indices.

- Shifting Investment Priorities: ESG factors are becoming increasingly integrated into traditional investment analysis, influencing investment decisions and portfolio allocation. Companies with strong ESG ratings are likely to attract higher valuations and attract a wider pool of investors.

- Regulatory Pressure: Governments and regulatory bodies are implementing stricter regulations regarding ESG reporting and disclosure, further driving the adoption of sustainable investment practices.

2. The Growth of Alternative Investments:

Traditional asset classes like stocks and bonds are facing increasing volatility and limited returns. This is prompting investors to explore alternative investment strategies, such as private equity, real estate, and infrastructure. These alternatives offer diversification benefits and potential for higher returns, but also come with higher risk and illiquidity.

Understanding the Impact:

- Diversification Beyond Traditional Assets: Alternative investments provide investors with the opportunity to diversify their portfolios beyond traditional equities and fixed income, potentially mitigating risk and enhancing returns.

- Access to Emerging Markets: Alternative investments often provide access to emerging markets and sectors that are not readily accessible through traditional investments.

- Long-Term Growth Potential: Many alternative investments are focused on long-term growth and value creation, offering potential for higher returns over the long term.

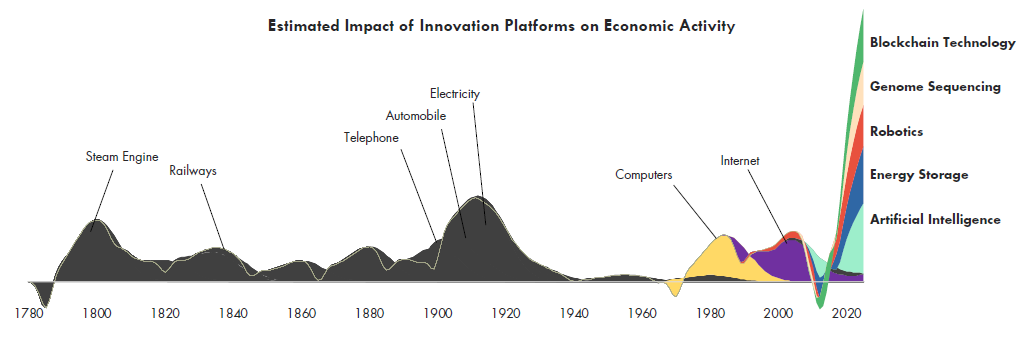

3. The Integration of Technology:

Technology is rapidly transforming the investment industry, driving efficiency, transparency, and accessibility. Artificial intelligence (AI), machine learning (ML), and big data analytics are being leveraged to enhance investment research, portfolio management, and risk assessment.

Understanding the Impact:

- Automated Investment Strategies: AI-powered robo-advisors are increasingly popular, offering personalized investment advice and portfolio management at a lower cost than traditional advisors.

- Enhanced Data Analysis: Advanced analytics tools enable investors to access and process vast amounts of data, leading to more informed investment decisions and improved risk management.

- Increased Transparency and Efficiency: Technology is facilitating greater transparency in the investment industry, streamlining processes and reducing costs.

4. The Rise of Impact Investing:

Impact investing focuses on generating both financial returns and positive social and environmental impact. Investors are seeking to invest in companies and projects that address pressing social and environmental challenges, such as climate change, poverty, and healthcare access.

Understanding the Impact:

- Investing for a Better World: Impact investing allows investors to align their investments with their values, contributing to a more sustainable and equitable future.

- Increased Investment Opportunities: The growing demand for impact investments is leading to the emergence of new investment vehicles and opportunities in sectors such as renewable energy, sustainable agriculture, and affordable housing.

- Measuring Social and Environmental Impact: Impact investing requires robust measurement frameworks to track and quantify the social and environmental impact of investments.

5. The Importance of Personalization and Customization:

Investors are demanding more personalized investment solutions that cater to their unique needs, risk tolerance, and financial goals. This is leading to the development of tailored investment strategies and customized portfolio management services.

Understanding the Impact:

- Personalized Investment Advice: Investors are seeking personalized financial advice and guidance from advisors who understand their specific needs and goals.

- Tailored Investment Strategies: Investment strategies are being customized to cater to individual investor profiles, risk appetites, and investment horizons.

- Increased Access to Financial Information: Technology is empowering investors with access to more financial information and tools, enabling them to make more informed investment decisions.

6. The Focus on Financial Literacy:

As investment options become more complex, financial literacy is becoming increasingly important. Investors are seeking to improve their understanding of financial markets, investment strategies, and risk management principles.

Understanding the Impact:

- Greater Investor Empowerment: Increased financial literacy empowers investors to make more informed investment decisions and manage their finances effectively.

- Reduced Financial Vulnerability: Financial literacy helps individuals make sound financial choices, reducing their vulnerability to scams and predatory financial products.

- Stronger Financial System: A financially literate population contributes to a more robust and stable financial system.

7. The Importance of Risk Management:

In an uncertain and volatile market, effective risk management is crucial. Investors are focusing on strategies to mitigate risk, protect their investments, and ensure the long-term sustainability of their portfolios.

Understanding the Impact:

- Diversification Strategies: Investors are diversifying their portfolios across different asset classes, industries, and geographies to reduce exposure to any single risk factor.

- Stress Testing and Scenario Planning: Investment managers are employing stress testing and scenario planning to evaluate the potential impact of different market events on their portfolios.

- Risk Monitoring and Control: Advanced risk management systems are being deployed to monitor and control risk exposure, ensuring that investments are aligned with investor risk tolerance.

8. The Rise of Decentralized Finance (DeFi):

DeFi is a rapidly growing sector leveraging blockchain technology to create decentralized financial systems. It offers alternative lending and borrowing options, decentralized exchanges, and other financial services, potentially disrupting traditional financial institutions.

Understanding the Impact:

- Increased Financial Inclusion: DeFi has the potential to increase financial inclusion by providing access to financial services for individuals and businesses who may not have access to traditional banking systems.

- Greater Transparency and Security: Blockchain technology offers greater transparency and security compared to traditional financial systems, potentially reducing fraud and corruption.

- Innovation in Financial Products and Services: DeFi is driving innovation in financial products and services, creating new opportunities for investors and financial institutions.

Related Searches

The trends discussed above are intertwined with several related searches that provide further insights into the evolving landscape of investment quality:

1. Investment Trends 2025: This broader search encompasses the overall trends shaping the investment landscape in 2025, including those related to technology, regulation, and investor behavior.

2. Future of Investing: This search explores the long-term outlook for the investment industry, considering factors such as technological advancements, demographic shifts, and geopolitical risks.

3. Investment Strategies 2025: This search focuses on specific investment strategies that are likely to be effective in the coming years, considering factors such as market volatility, interest rates, and inflation.

4. Top Investments 2025: This search aims to identify the most promising investment opportunities in 2025, considering factors such as industry growth, technological innovation, and regulatory changes.

5. Best Investment Apps 2025: This search focuses on the best investment apps and platforms available to investors in 2025, considering factors such as user experience, functionality, and security.

6. Investment Advice for Beginners: This search provides resources and guidance for novice investors, helping them understand the basics of investing and make informed decisions.

7. Investment Portfolio Management: This search explores the principles and strategies involved in managing investment portfolios, considering factors such as asset allocation, risk management, and performance monitoring.

8. Investment Research and Analysis: This search focuses on the tools and techniques used to conduct investment research and analysis, including fundamental analysis, technical analysis, and quantitative analysis.

FAQs

Q: How can investors prepare for these investment quality trends in 2025?

A: Investors can prepare for these trends by:

- Educating themselves about ESG investing: Understanding the principles of ESG investing and identifying companies with strong ESG practices.

- Exploring alternative investment opportunities: Considering diversifying their portfolios with alternative investments such as private equity, real estate, or infrastructure.

- Embracing technology: Leveraging technology to enhance investment research, portfolio management, and risk assessment.

- Considering impact investing: Seeking investment opportunities that align with their values and contribute to positive social and environmental change.

- Prioritizing financial literacy: Improving their understanding of financial markets, investment strategies, and risk management principles.

Q: What are the potential risks associated with these trends?

A: While these trends offer significant opportunities, they also present certain risks:

- ESG investing: The lack of standardized ESG reporting frameworks and the potential for "greenwashing" can make it challenging to evaluate companies’ true sustainability performance.

- Alternative investments: Alternative investments often involve higher risk and illiquidity, requiring careful due diligence and a long-term investment horizon.

- Technology: The rapid pace of technological change can make it challenging to keep up with the latest innovations and ensure that investment strategies remain effective.

- Impact investing: Measuring and verifying the social and environmental impact of investments can be complex and subjective.

- DeFi: The decentralized nature of DeFi can create challenges in terms of regulation, security, and consumer protection.

Q: How can investors navigate these risks and maximize their returns?

A: Investors can navigate these risks and maximize their returns by:

- Conducting thorough due diligence: Carefully researching investment opportunities and understanding the associated risks and potential rewards.

- Diversifying their portfolios: Spreading investments across different asset classes, industries, and geographies to reduce overall risk.

- Working with experienced advisors: Seeking professional advice from investment professionals who understand the complexities of the market and can help develop tailored investment strategies.

- Monitoring their investments regularly: Tracking the performance of their investments and making adjustments as needed to stay aligned with their financial goals.

- Staying informed about market trends: Continuously learning about the latest investment trends and adapting their strategies accordingly.

Tips

- Start early: Begin investing early to benefit from the power of compounding returns.

- Set clear financial goals: Define your financial objectives and develop a plan to achieve them.

- Invest for the long term: Avoid short-term speculation and focus on building a diversified portfolio for long-term growth.

- Don’t chase returns: Resist the temptation to invest in hot stocks or speculative investments.

- Seek professional advice: Consult with a qualified financial advisor to develop a personalized investment strategy.

- Stay disciplined: Stick to your investment plan and avoid emotional decision-making.

- Review your portfolio regularly: Periodically assess your investment portfolio and make adjustments as needed.

Conclusion

The investment landscape in 2025 will be shaped by a confluence of trends, presenting both opportunities and challenges for investors. Understanding these trends and adapting investment strategies accordingly is crucial for navigating the complexities of the future market and maximizing returns. By embracing sustainability, exploring alternative investments, leveraging technology, and prioritizing financial literacy, investors can position themselves for success in the evolving world of investment.

It is important to remember that investing involves inherent risks, and past performance is not indicative of future results. Always conduct thorough research, seek professional advice, and make informed decisions aligned with your individual financial goals and risk tolerance.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Future: Investment Quality Trends in 2025. We hope you find this article informative and beneficial. See you in our next article!