Navigating The Future: A Guide To Trends Investments 2025

Navigating the Future: A Guide to Trends Investments 2025

Navigating the Future: A Guide to Trends Investments 2025

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Future: A Guide to Trends Investments 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Future: A Guide to Trends Investments 2025

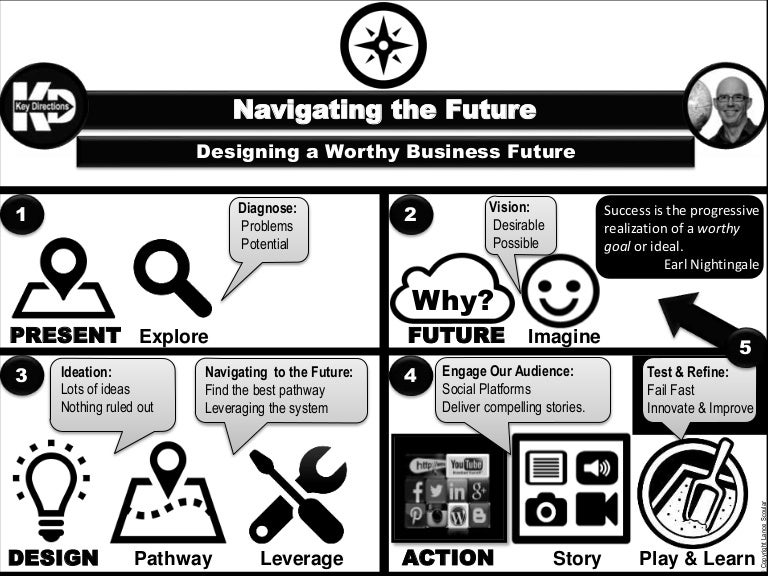

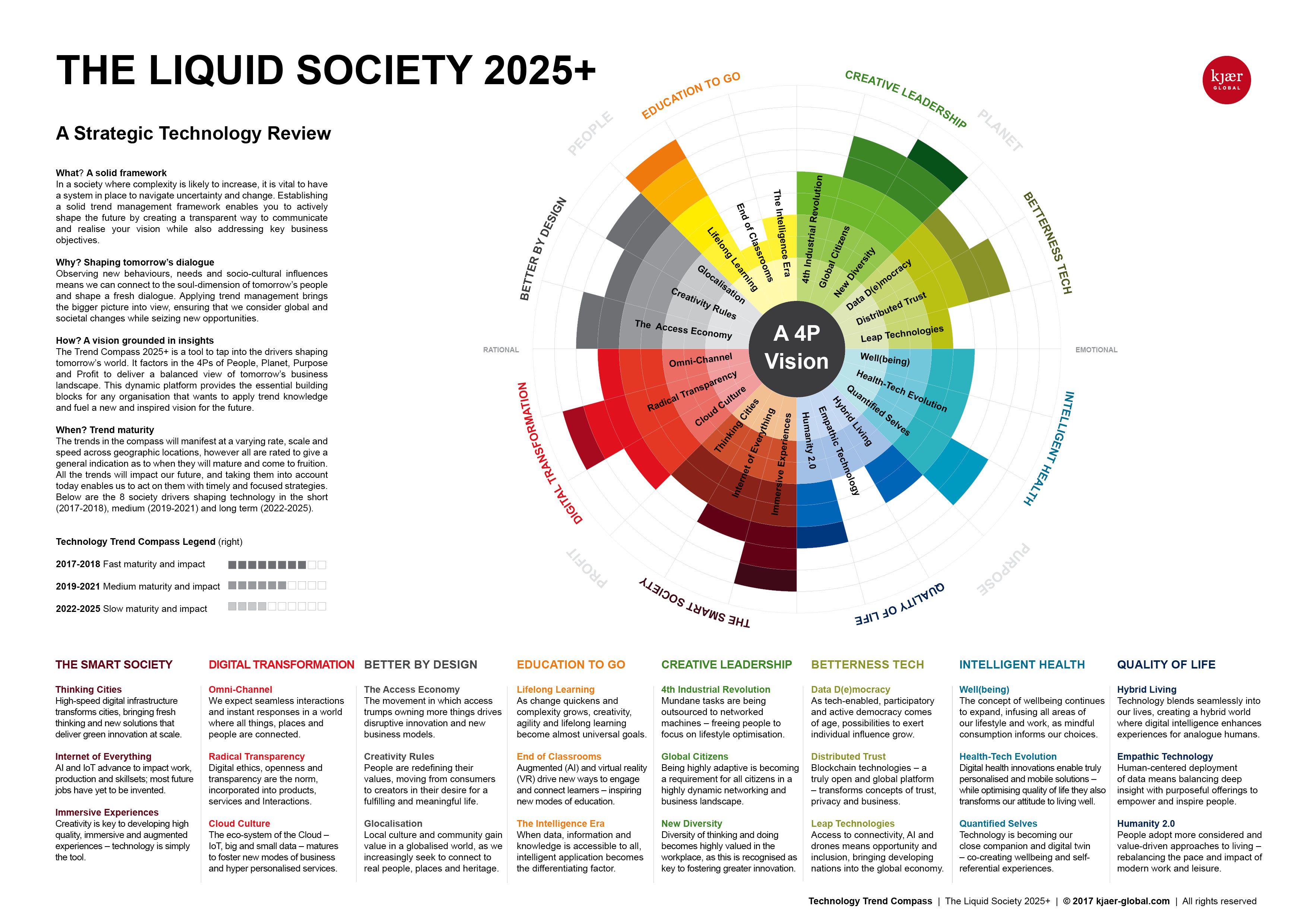

The world of finance is constantly evolving, driven by technological advancements, shifting demographics, and global events. Predicting the future is inherently challenging, but understanding the emerging trends can guide investors towards opportunities that align with the evolving landscape. This comprehensive guide delves into the key trends investments 2025 and offers insights into their potential impact on the financial markets.

1. The Rise of Sustainable Investing:

Sustainability is no longer a niche concept; it’s a core driver of investment decisions. Investors are increasingly seeking companies with strong environmental, social, and governance (ESG) practices. This trend is driven by several factors:

- Growing awareness of climate change: The urgency of addressing climate change is fueling demand for investments in renewable energy, green technologies, and sustainable agriculture.

- Increased regulatory scrutiny: Governments and regulators are implementing stricter ESG reporting requirements, pushing companies to be more transparent about their sustainability practices.

- Investor preference: Millennials and Gen Z are prioritizing ethical and responsible investments, driving demand for ESG-focused funds and portfolios.

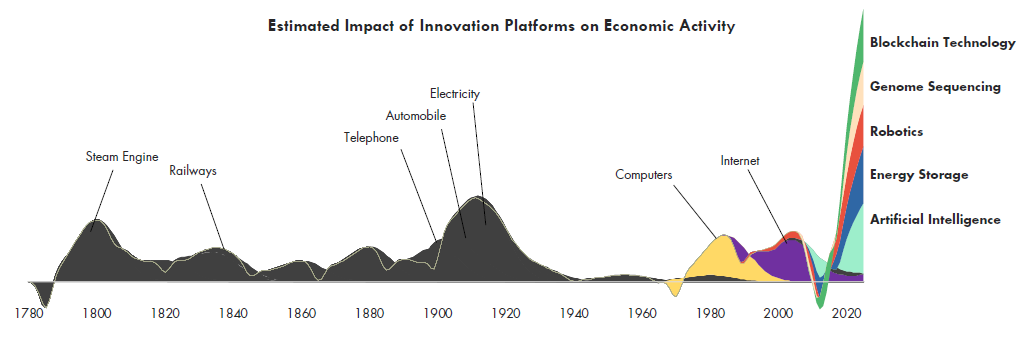

2. The Exponential Growth of Artificial Intelligence (AI):

AI is transforming every industry, from healthcare to manufacturing. Its impact on finance is particularly significant, leading to:

- Automated investment management: AI-powered robo-advisors are becoming increasingly popular, offering personalized and cost-effective investment solutions.

- Enhanced risk management: AI algorithms can analyze vast amounts of data to identify potential risks and optimize portfolio performance.

- Fraud detection: AI can detect and prevent financial fraud with greater accuracy and efficiency than traditional methods.

3. The Blockchain Revolution:

Blockchain technology, the foundation of cryptocurrencies, is disrupting traditional financial systems. Its key benefits include:

- Decentralization: Blockchain removes intermediaries, enabling peer-to-peer transactions and greater transparency.

- Security: Cryptographic techniques ensure the integrity and immutability of data on the blockchain.

- Efficiency: Blockchain can streamline processes and reduce transaction costs.

4. The Democratization of Finance:

Financial technology (FinTech) is breaking down barriers to access and making financial services more accessible to everyone. Key trends include:

- Mobile banking: Smartphones are becoming the primary channel for banking, allowing users to manage finances on the go.

- Microfinance: Fintech companies are providing microloans and other financial services to underserved populations.

- Crowdfunding: Platforms allow individuals to invest in startups and other ventures directly.

5. The Importance of Data Analytics:

Data is the new currency, and its analysis is crucial for making informed investment decisions. Advanced analytics tools allow investors to:

- Identify market trends: By analyzing market data, investors can identify emerging trends and capitalize on opportunities.

- Optimize portfolio performance: Data analytics can help investors understand their risk tolerance and allocate assets strategically.

- Predict market movements: Sophisticated algorithms can analyze historical data and predict future market behavior.

6. The Rise of Alternative Investments:

Traditional asset classes, such as stocks and bonds, are becoming less attractive due to low interest rates and market volatility. Investors are increasingly exploring alternative investments, including:

- Real estate: Real estate offers diversification and potential for capital appreciation.

- Private equity: Investments in private companies offer higher returns but also carry greater risk.

- Hedge funds: Hedge funds use sophisticated strategies to generate returns in all market conditions.

7. The Impact of Geopolitical Events:

Global events, such as trade wars and political instability, can have a significant impact on financial markets. Investors need to be aware of these risks and adjust their portfolios accordingly.

- Emerging markets: Emerging markets offer growth potential but also come with higher risks.

- Geopolitical risk: Investors need to consider the impact of geopolitical events on specific countries and industries.

8. The Importance of Financial Literacy:

Financial literacy is essential for making informed investment decisions. Individuals need to understand:

- Basic financial concepts: Concepts like risk, return, and diversification are crucial for understanding investment strategies.

- Different investment products: Investors need to be aware of the various investment options available and their associated risks and rewards.

- Financial planning: Financial planning helps individuals set financial goals and develop strategies to achieve them.

Related Searches and FAQs:

Related Searches:

- Future of investing

- Investment trends 2025

- Top investment opportunities

- Best investments for the future

- How to invest in 2025

- Investing in technology

- Sustainable investment trends

- Future of finance

FAQs:

-

Q: What are the best investments for 2025?

- A: The best investments depend on individual circumstances, risk tolerance, and financial goals. However, emerging trends suggest opportunities in sustainable investing, AI, blockchain, and alternative investments.

-

Q: How can I invest in AI?

-

A: You can invest in AI through various means:

- Direct investment: Invest in companies developing AI technologies.

- AI-focused ETFs: Exchange-traded funds (ETFs) that track AI companies.

- Robo-advisors: AI-powered platforms that manage your investments based on your goals.

-

A: You can invest in AI through various means:

-

Q: Is blockchain a good investment?

- A: Blockchain technology is still in its early stages, but it holds significant potential for disruption. Investors should carefully consider the risks and rewards before investing in blockchain.

-

Q: How can I improve my financial literacy?

-

A: There are numerous resources available to improve financial literacy, including:

- Online courses: Many online platforms offer courses on personal finance and investing.

- Books and articles: Numerous books and articles provide insights into financial concepts and strategies.

- Financial advisors: Consulting with a qualified financial advisor can provide personalized guidance.

-

A: There are numerous resources available to improve financial literacy, including:

Tips for Investing in 2025:

- Diversify your portfolio: Spread your investments across different asset classes to reduce risk.

- Focus on long-term goals: Avoid short-term speculation and focus on building wealth over time.

- Stay informed about market trends: Regularly research and analyze market trends to make informed investment decisions.

- Consider sustainable investing: Align your investments with your values and contribute to a more sustainable future.

- Embrace technological advancements: Utilize AI-powered tools and platforms to enhance your investment strategies.

Conclusion:

Trends investments 2025 offer both opportunities and challenges for investors. By understanding the key trends and adapting their strategies accordingly, investors can navigate the evolving financial landscape and achieve their financial goals. The future of finance is dynamic and driven by innovation, sustainability, and technological advancements. Investors who stay informed, embrace change, and prioritize financial literacy will be well-positioned to thrive in this evolving environment.

![The Future of Finance [Infographic]](https://infographicjournal.com/wp-content/uploads/2019/01/The-Future-of-Finance-feat.png)

Closure

Thus, we hope this article has provided valuable insights into Navigating the Future: A Guide to Trends Investments 2025. We thank you for taking the time to read this article. See you in our next article!