Navigating The Future: A Guide To Investing In Emerging Trends For 2025

Navigating the Future: A Guide to Investing in Emerging Trends for 2025

Navigating the Future: A Guide to Investing in Emerging Trends for 2025

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Future: A Guide to Investing in Emerging Trends for 2025. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Future: A Guide to Investing in Emerging Trends for 2025

The landscape of business and technology is constantly evolving, and with it, the opportunities for investment. Identifying and capitalizing on emerging trends can be a powerful strategy for investors seeking to maximize returns and secure a prosperous future. As we approach 2025, several key trends are poised to shape the global economy and offer exciting investment possibilities. This comprehensive guide will delve into these trends, providing insights into their potential impact and outlining strategies for navigating this dynamic investment landscape.

Understanding the Power of Trend-Driven Investment

Investing in trends is not simply following the latest fad; it’s about discerning the underlying forces driving societal and technological change. By identifying these forces, investors can position themselves to benefit from the exponential growth and disruption that often accompany emerging trends.

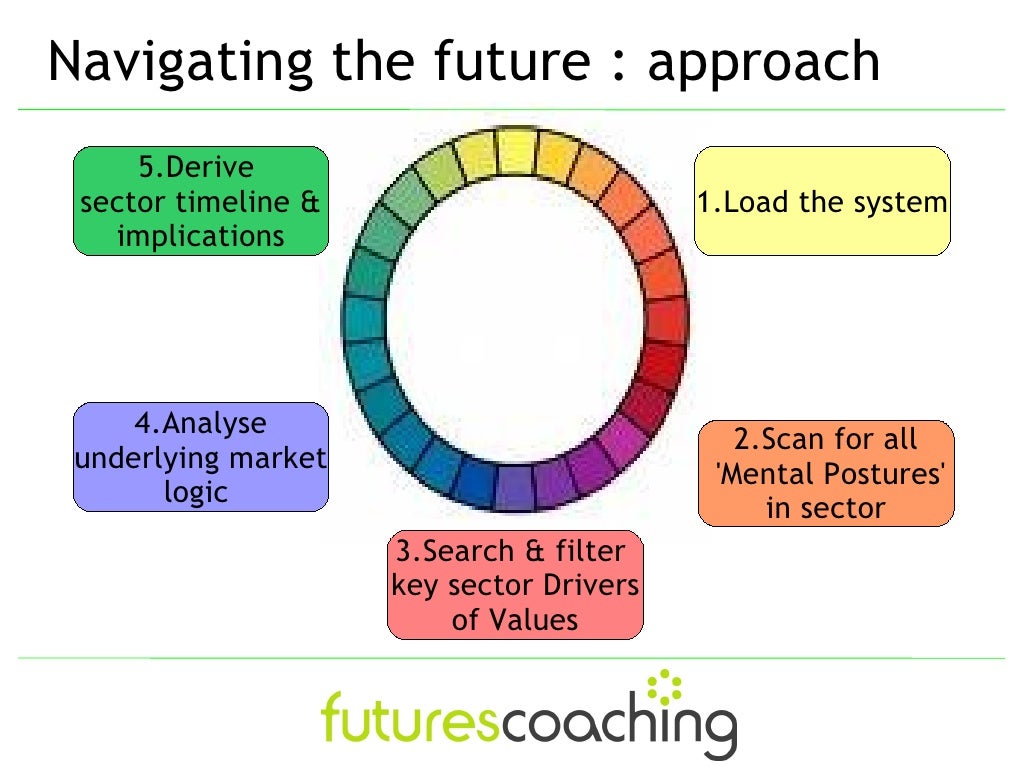

The Importance of Strategic Foresight

Trend analysis involves more than just identifying popular topics. It requires a deep understanding of the factors shaping these trends, including:

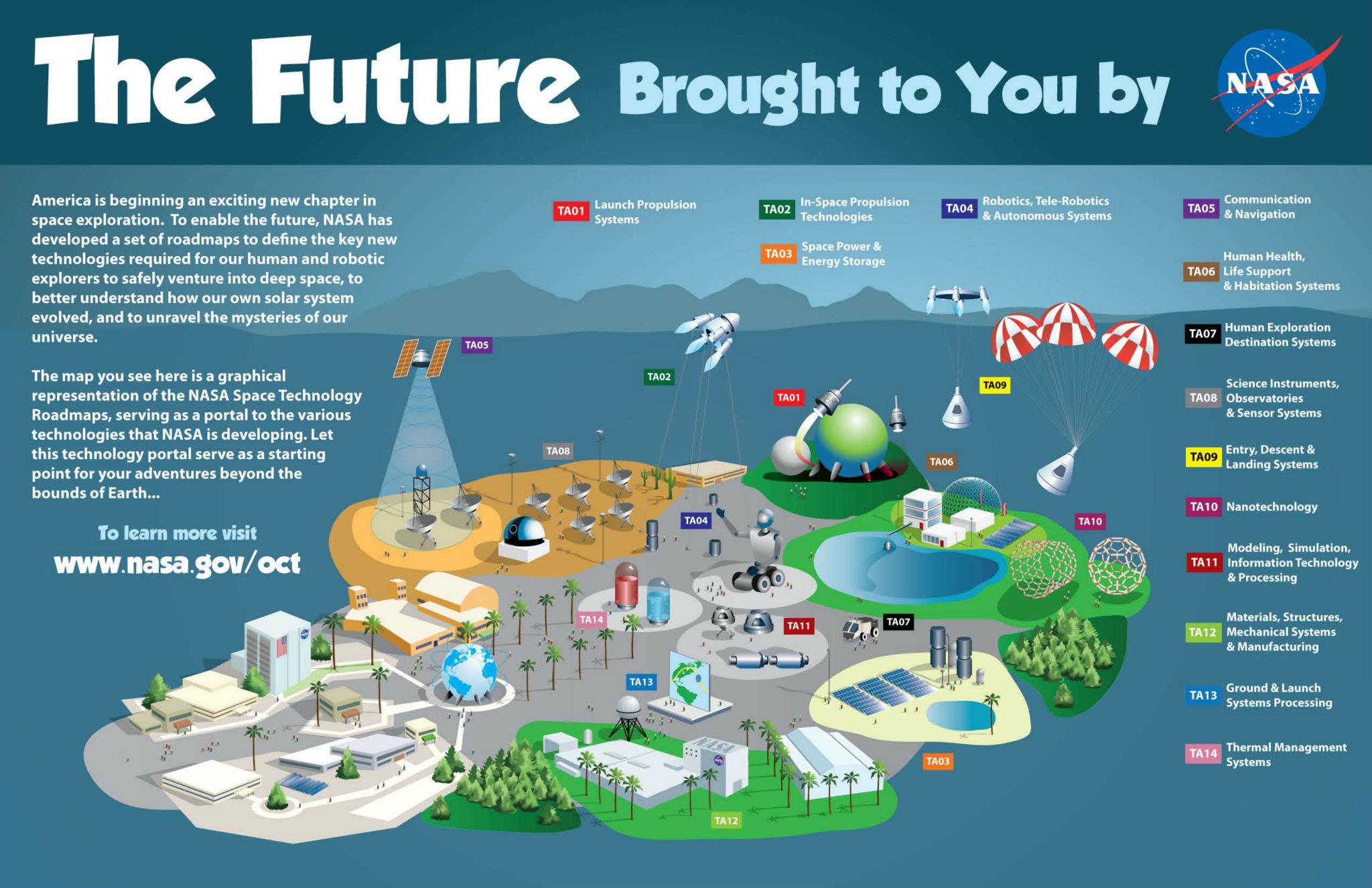

- Technological Advancements: The rapid pace of innovation in fields like artificial intelligence, biotechnology, and renewable energy is driving significant economic shifts.

- Demographic Shifts: Changes in population demographics, such as aging populations and urbanization, are creating new demands and opportunities in sectors like healthcare, infrastructure, and consumer goods.

- Consumer Behavior: Evolving consumer preferences, driven by factors like sustainability, personalization, and digital experiences, are shaping the future of industries ranging from retail to entertainment.

- Geopolitical Factors: Global events and political shifts influence market dynamics and investment strategies. Understanding these factors is crucial for navigating potential risks and opportunities.

Key Trends Shaping the Investment Landscape of 2025

1. The Rise of the Metaverse:

The metaverse, a collective virtual space encompassing augmented and virtual reality experiences, is poised to revolutionize how we interact with technology and each other. This trend presents investment opportunities across various sectors, including:

- VR/AR Hardware and Software: Companies developing headsets, software, and platforms for immersive experiences.

- Content Creation and Distribution: Businesses creating and distributing virtual worlds, games, and experiences.

- E-commerce and Digital Assets: Platforms for virtual goods, avatars, and digital currencies within the metaverse.

2. The Exponential Growth of AI:

Artificial intelligence is rapidly transforming industries, automating tasks, and driving innovation. Key investment areas include:

- AI Software and Services: Companies developing AI algorithms, platforms, and applications for various sectors.

- AI Hardware: Manufacturers of specialized chips and computing infrastructure optimized for AI workloads.

- AI-Driven Businesses: Companies leveraging AI for automation, data analysis, and personalized experiences.

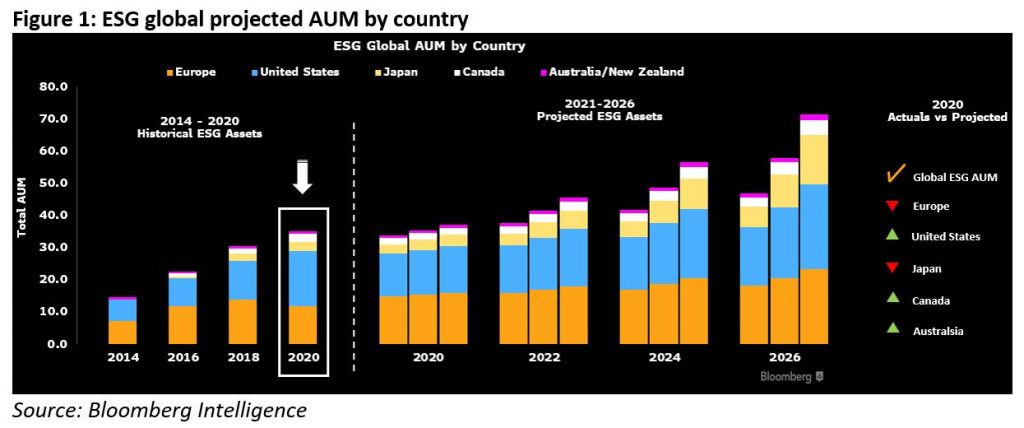

3. Sustainable Investing: A Growing Movement:

Environmental, social, and governance (ESG) factors are increasingly influencing investment decisions. Investors are seeking companies with strong sustainability practices and a positive social impact.

- Renewable Energy: Companies developing and deploying renewable energy technologies like solar, wind, and geothermal power.

- Sustainable Agriculture: Businesses focused on sustainable food production, reducing environmental impact, and improving food security.

- Green Infrastructure: Companies building and maintaining sustainable infrastructure, such as electric vehicle charging stations and green buildings.

4. The Future of Healthcare:

Advances in biotechnology, personalized medicine, and digital health are transforming healthcare delivery and creating new investment opportunities.

- Biotechnology and Pharmaceuticals: Companies developing innovative treatments, diagnostics, and therapies.

- Digital Health and Telemedicine: Companies providing remote healthcare services, wearable technology, and digital health platforms.

- Precision Medicine: Businesses focused on personalized treatment plans based on individual genetic profiles.

5. The Rise of the Sharing Economy:

The sharing economy, characterized by peer-to-peer platforms for accessing goods and services, continues to expand.

- Ride-hailing and Transportation: Companies providing on-demand transportation services.

- Short-Term Rentals: Platforms connecting travelers with temporary accommodation options.

- Collaborative Consumption: Businesses facilitating the sharing of resources like tools, equipment, and skills.

6. The Power of Data and Analytics:

Data is the new oil, and companies are increasingly leveraging data analytics to gain insights, optimize operations, and personalize customer experiences.

- Big Data and Analytics Platforms: Companies developing and providing data management, analysis, and visualization tools.

- Data Security and Privacy: Businesses specializing in data protection, encryption, and compliance with privacy regulations.

- Data-Driven Businesses: Companies across various sectors utilizing data analytics for decision-making and innovation.

7. The Growth of the Digital Economy:

The digital economy encompasses online commerce, digital media, and digital services.

- E-commerce and Online Retail: Companies operating online marketplaces and selling goods and services digitally.

- Digital Media and Entertainment: Businesses providing streaming services, online gaming, and digital content creation.

- Fintech and Digital Payments: Companies offering financial services, payment processing, and digital banking solutions.

8. The Future of Work:

The future of work is characterized by automation, remote work, and the rise of gig economy platforms.

- Automation and Robotics: Companies developing and deploying robots and automation systems to improve efficiency and productivity.

- Remote Work Platforms: Businesses providing tools and infrastructure for remote work, collaboration, and communication.

- Gig Economy Platforms: Companies connecting workers with freelance opportunities and temporary assignments.

Investing in Trends: Strategies and Considerations

1. Diversification is Key:

Spread your investments across multiple trends and sectors to mitigate risk and maximize potential returns.

2. Conduct Thorough Research:

Before investing in any trend, thoroughly research the companies, technologies, and market dynamics involved.

3. Consider Long-Term Growth:

Trends often have a long-term impact, so focus on companies with sustainable growth potential and a strong track record.

4. Stay Updated on Industry Developments:

The landscape of emerging trends is constantly evolving. Stay informed about new advancements, market shifts, and regulatory changes.

5. Seek Professional Advice:

Consult with financial advisors to develop a tailored investment strategy that aligns with your risk tolerance and financial goals.

FAQs about Investing in Trends for 2025

Q: Is investing in trends risky?

A: Investing in emerging trends inherently involves risk, as the success of these trends is not guaranteed. However, by conducting thorough research, diversifying your portfolio, and adopting a long-term perspective, you can mitigate risk and enhance your chances of success.

Q: How can I identify promising trends?

A: Stay informed about industry news, follow thought leaders, attend industry events, and analyze market trends through research reports and data analysis.

Q: What are some key factors to consider when evaluating investment opportunities?

A: Consider the company’s financial health, management team, competitive landscape, technology, and potential for growth and innovation.

Q: How can I stay up-to-date on emerging trends?

A: Subscribe to industry publications, follow relevant social media accounts, attend webinars and conferences, and engage in online communities dedicated to emerging trends.

Tips for Investing in Trends for 2025

1. Focus on Disruptive Technologies:

Invest in companies developing technologies that have the potential to disrupt existing industries and create new markets.

2. Seek Companies with Strong Leadership:

Look for companies with experienced and visionary leaders who can effectively navigate the challenges and opportunities presented by emerging trends.

3. Consider Sustainable Investing:

Align your investments with your values by choosing companies with strong ESG practices and a positive social impact.

4. Embrace Innovation:

Invest in companies that prioritize innovation and research and development, as they are more likely to stay ahead of the curve in rapidly evolving industries.

5. Be Patient and Consistent:

Investing in emerging trends requires a long-term perspective. Be patient, avoid impulsive decisions, and stay committed to your investment strategy.

Conclusion

Investing in trends for 2025 offers a compelling opportunity for investors seeking to capitalize on the transformative forces shaping the global economy. By understanding the key trends, conducting thorough research, and adopting a strategic approach, investors can position themselves to benefit from the growth and disruption that these trends will bring. Remember, navigating this dynamic landscape requires continuous learning, adaptability, and a willingness to embrace the future.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Future: A Guide to Investing in Emerging Trends for 2025. We appreciate your attention to our article. See you in our next article!